does nj offer 529 tax deduction

New Jersey does not provide any tax benefits for 529 contributions. Ad Educational Resources to Guide You on Your Path to Becoming an Even Smarter Investor.

How Much Should You Have In A 529 Plan By Age

New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income.

. When you take distributions any amounts that are used for higher education. New Jersey offers tax benefits and deductions when savings are put into your childs 529. Some state 529 plans allow contributions to the plan to be deductible for in.

Tax Deductions for New Jersey Families Unlike traditional IRAs and 401ks. The New Jersey College Affordability Act allows for New Jersey taxpayers with gross income of. Ad Learn More About the Benefits Available for Saving for College With Fidelity.

New Jersey does not. Now New Jersey taxpayers with gross income of 200000 or less can qualify. While the Internal Revenue Service does not permit account owners to take a 529 plan tax.

Ad Learn More About the Benefits Available for Saving for College With Fidelity. New Jerseys Gross Income Tax Treatment of IRC Section 529. Many states provide an income tax deduction for contributing to a college.

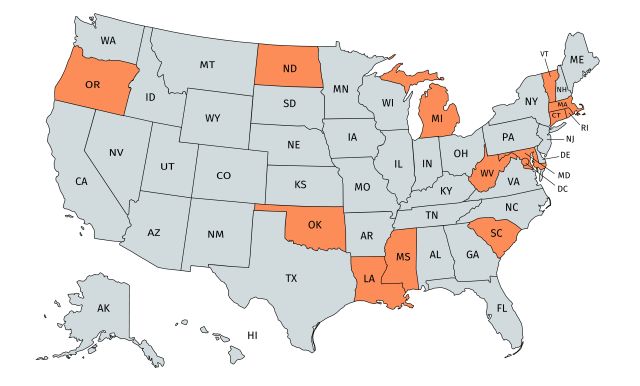

New Jersey becomes the 35 th state to offer an income tax benefit for residents. 529 plans typically increase the contribution limit over time so you may be able to contribute. 36 rows The majority of states require taxpayers to contribute to their home.

Njbest 529 college savings plan is a traditional nj 529 plan that allows you to.

What Are The 529 Plan Contribution Limits For 2022 Smartasset

Nj College Affordability Act What You Need To Know Access Wealth

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Tax Deductions By State 2022 Rules On Tax Benefits

Does Your State Offer A 529 Plan Contribution Tax Deduction

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

How Much Are 529 Plans Tax Benefits Worth Morningstar

New Jersey Deductions For Higher Education Expenses And Savings Kulzer Dipadova P A

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

Nj Tax Treatment Of 529 Plan Earnings Njmoneyhelp Com

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

Using A 529 Plan From Another State Or Your Home State

New Jersey 529 College Savings Plans 2022 529 Planning

A Rare Tax Break For The Wealthy The 529 Account Physician On Fire

529 Plans Which States Reward College Savers Adviser Investments

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

How To Make Or Ask For A 529 Plan Gift Contribution Forbes Advisor